Financial Highlights

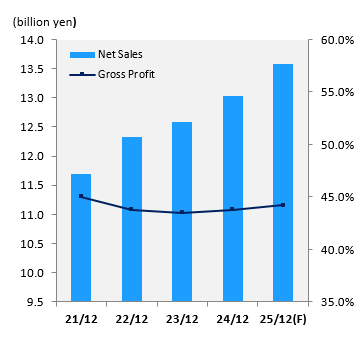

Net Sales

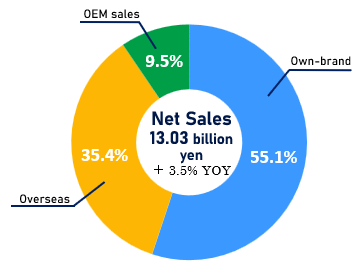

Net Sales by Sales Format

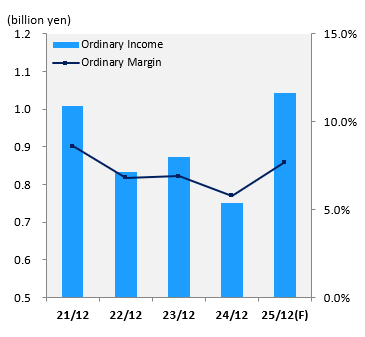

Ordinary Income

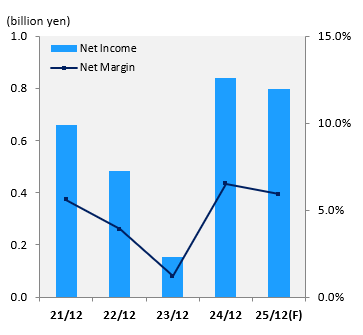

Net Income

Business Results Data (Cons.)

Unit:million yen

| FY 2021 | FY 2022 | FY 2023 | FY 2024 | FY 2025(Est.) | |

|---|---|---|---|---|---|

| Net Sales | 11,698 | 12,326 | 12,585 | 13,030 | 13,583 |

|

Cost of Sales |

6,438 55.0% |

6,931 56.2% |

7,107 56.5% |

7,326 56.2% |

7,577 55.8% |

|

Gross Profit |

5,260 45.0% |

5,395 43.8% |

5,478 43.5% |

5,704 43.8% |

6,006 44.2% |

|

SG&A expenses |

4,393 37.6% |

4,654 37.8% |

4,675 37.1% |

5,011 38.5% |

5,004 36.8% |

|

Operating Income |

866 7.4% |

741 6.0% |

803 6.4% |

692 5.3% |

1,002 7.4% |

|

Ordinary Income |

1,009 8.6% |

834 6.8% |

872 6.9% |

750 5.8% |

1,043 7.7% |

|

Net Income |

660 5.6% |

482 3.9% |

154 1.2% |

840 6.5% |

796 5.9% |

Net Sales by Sales Format(cons.)

Unit:million yen

| FY 2021 | FY 2022 | FY 2023 | FY 2024 | FY 2025(Est.) | |

|---|---|---|---|---|---|

|

Own-brand |

6,884 58.8% |

6,986 56.7% |

6,920 55.0% |

7,182 55.1% |

7,530 55.4% |

| Overseas (%) |

3,493 29.9% |

4,000 32.5% |

4,257 33.8% |

4,608 35.4% |

4,719 34.7% |

| OEM Sales (%) |

1,320 11.3% |

1,340 10.9% |

1,407 11.2% |

1,239 9.5% |

1,334 9.8% |

| Total (%) |

11,698 100.0% |

12,326 100.0% |

12,585 100.0% |

13,030 100.0% |

13,583 100.0% |

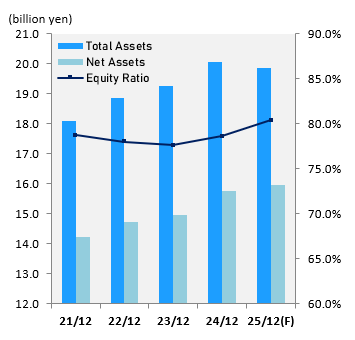

Graph Showing Financial Position

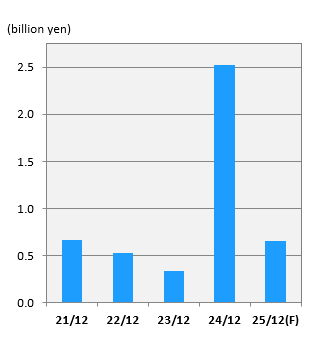

Free Cash Flow

Financial Position Data(cons.)

Unit:million yen

| FY 2021 | FY 2022 | FY 2023 | FY 2024 | FY 2025(Est.) | |

|---|---|---|---|---|---|

|

Current Assets |

11,575 | 12,128 | 12,722 | 13,940 | 14,807 |

|

Fixed Assets |

6,500 | 6,736 | 6,535 | 6,107 | 5,051 |

|

Total Assets |

18,075 | 18,865 | 19,258 | 20,047 | 19,857 |

|

Current Liabilities |

2,573 | 2,816 | 2,967 | 3,105 | 2,915 |

|

Fixed Liabilities |

1,282 | 1,325 | 1,347 | 1,191 | 984 |

|

Total Liabilities |

3,855 | 4,141 | 4,314 | 4,296 | 3,899 |

|

Shareholders' Equity |

14,220 | 14,723 | 14,944 | 15,750 | 15,958 |

|

Equity Ratio |

78.7% | 78.0% | 77.6% | 78.6% | 80.4% |

Cash Flow Data

Unit:million yen

| FY 2021 | FY 2022 | FY 2023 | FY 2024 | FY 2025 (Est.) |

|

|---|---|---|---|---|---|

|

Net cash provided by (used in) operating activities |

1,248 | 478 | 698 | 2,249 | 818 |

|

Net cash provided by (used in) investing activities |

△ 585 | 43 | △ 363 | 270 | △ 167 |

|

Net cash provided by (used in) financing activities |

△ 442 | △ 356 | △ 362 | △ 877 | △ 365 |

|

Net increase in cash and cash equivalents |

330 | 288 | 68 | 1,891 | 386 |

|

Cash and cash equivalents at end of year |

3,413 | 3,702 | 3,770 | 5,662 | 5,602 |

|

Free Cash Flow |

663 | 522 | 335 | 2,520 | 651 |

- NOTE 1) Figures are shown on a consolidated basis.

- NOTE 2) Figures are shown rounded down to the nearest million yen.

- NOTE 3) Free Cash Flow is represented as the total of CF from operating activities + CF from investment activities.

Investment index

| FY 2021 | FY 2022 | FY 2023 | FY 2024 | FY 2025(Est.) | |

|---|---|---|---|---|---|

| ROE | 4.8% | 3.3% | 1.0% | 5.5% | 5.0% |

| EPS(yen) | 72.61 | 53.00 | 16.92 | 95.41 | 92.67 |

| BPS(yen) | 1,563.55 | 1,618.10 | 1,641.59 | 1,833.67 | 1,857.81 |

|

Dividend per Share (yen) |

37 | 37 | 37 | 39 | 37 |

|

Dividend Payout Ratio(cons.) |

51.0% | 69.8% | 218.7% | 40.9% | 39.9% |